This chapter introduces the evolution of mobile communications. As the mobile communications’ context is expected to become increasingly platform-based and ecosystemic, it is important to distinguish relevant perspectives and map the developments in the field. This chapter provides an outlook from the first (1G) to fifth (5G) generation of mobile communications by looking at technology and standardization, relevant regulatory developments and contents, and specifically characterizes the business ecosystems toward the sixth generation of mobile communications (6G). The purpose of the chapter is to provide a contextual setting for the discussions presented in the subsequent chapters by showing the emergence and evolutionary continuum of mobile communications from 1 to 6G.

You have full access to this open access chapter, Download chapter PDF

Natural selection will not remove ignorance from future generations.

(Richard Dawkins)

Worldwide digitalization has been enabled by the successive mobile communications generations over the past three decades. Each generation has introduced new use cases and technical capabilities, while optimizing the use cases of the previous generation. Overall, technology can be seen to serve an enabling role in mobile communications. In this historical development, the commercialization cycle of mobile communications has followed three steps: (1) definition, (2) standardization and implementation, and (3) deployment and use. At the definition stage, the innovation from companies and research organizations is mediated together with national authorities in the global ITU-R (International Telecommunication Union Radiocommunication sector) to form a framework and develop usage scenarios for the radio aspects of mobile communications technology. After the definition of the requirements for the radio interface at the ITU-R, standardization bodies and firms negotiate standardization and implementation via standard releases that are the basis for the implementations by different technology vendors. As the technical systems and solutions needed in a technology generation have been developed, they are deployed and utilized by the mobile operators in different business implementations (Ahokangas et al., 2023). This deployment and use are, however, delimited by regulation as the telecommunications is a highly regulated field.

This chapter provides an overview and brief introduction to the mobile communications industry. The chapter will start with a brief description of technological development in the field in different technology generations from the first to sixth generation and discuss the role of standardization in this development. Next, the chapter will provide a short introduction to the role of regulation in mobile communications. The chapter will conclude with a characterization of the mobile communications business. This chapter serves as a starting point for the discussions presented in the subsequent chapters.

From the first generation, the mobile network system architecture has been defined by the radio access technology, access and core network routing, and the associated services related to voice, messaging, data transfer, mobility, authentication, and access control. After the first generation (1G) analog voice only service, the second generation (2G) introduced a digital mobile system with text messaging and mobile phones as a personal portable device in addition to a voice service. The third generation (3G) with mobile broadband data brought access to mobile multimedia and significantly lowered the cost of the voice service. The fourth generation (4G) expanded the multimedia service offering across digital industries built around smart phones. 4G lowered the cost of data while introducing video to consumers and machine-type communications to serve vertical industries. The ongoing deployment of the fifth generation (5G) has drastically increased the number of communicating objects (David & Berndt, 2018). For consumers interactive low-cost video and for enterprises the industrial IoT (Internet of Things) are paving the way toward human augmentation and digital-physical fusion. Up to 4G mobile communications, the connectivity business has remained surprisingly unchanged allowing the incumbent mobile network operators (MNOs) to dominate the market, although they have been seriously challenged by the content-owning, cloud-based over-the-top (OTT) Internet giants (Ahokangas et al., 2013).

For 5G, the ITU-R vision framework for international mobile telecommunications IMT-2020 and beyond presented in (ITU-R, 2020) adopted a service-centric approach to the 5G use case definition. The IMT-2020 vision identified three services classes, enhanced mobile broadband (eMBB) targeted at consumers, ultra-reliable low-latency communications (URLLC) for mission-critical services for organizations such as factories, and massive machine-type communications (mMTC) to connect IoT. The fifth generation mobile network 5G new radio (NR) solution was standardized by 3GPP in release 15 and commercially deployed in 2019 based on the non-standalone (NSA) architecture where a 5G radio access network (RAN) operates on a legacy 4G LTE core network. Innovations in a new user equipment (UE), radio access network (RAN), and 5G core (5GC) designs enable substantial improvements across the main service domains eMBB, URLLC, and mMTC. In particular, the new active antenna beam-based physical layer RAN design allows operation in higher frequencies up to mmWaves with wider bandwidths. The 5G system architecture including the 5GC became available from 2020 as standalone (SA) enabling the deployment of private enterprise and industrial 5G networks (Parkvall et al., 2017).

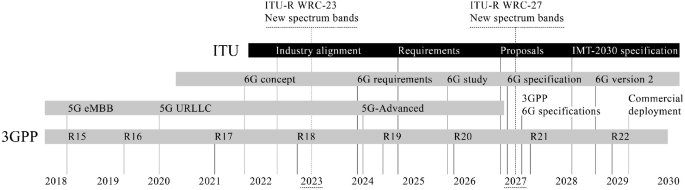

The 5G standard evolution in releases 16 and 17, as depicted in Fig. 2.1, expands the 5G ecosystem particularly for industrial domain via innovations such as time sensitive communication, small data transmission, and UE energy saving. 3GPP work on release 18 5G-Advanced (5GA) is due in 2024 and the first deployments are expected around 2025 (Chen et al., 2022). 5GA will provide an intelligent network platform utilizing machine learning (ML) to adapt to its environment, new classes of devices and enhance support for novel applications such as truly mobile extended reality (XR) services. Furthermore, 5GA will embed high-precision location, presence and timing technologies, and device innovations will make drone optimized and non-terrestrial networks (NTN) such as satellite connectivity a commonplace feature. For the Industrial Internet of things (IIoT) ecosystem, the release will offer connections from low-cost and low-data rate to extremely low latency with pinpoint accuracy (Lin, 2022).

In previous generations, the end-to-end network provided the same service to all users and the only option to offer guaranteed provision for a critical application, e.g., for public safety or critical infrastructure services was to deploy a dedicated physical network. In the 5GC network, network slicing allows operators to create thousands of virtual, independent networks within the same physical network infrastructure that connect from the device through to the application. Network slicing enables operators to efficiently package novel 5G network capabilities into differentiated, guaranteed service level agreement-based (SLA) services in a cost-effective way.

The 5GA platform is visioned to introduce and extend a variety of novel applications and use cases across industries in 2025, and beyond (see, e.g., Ghosh et al., 2019; Nakamura, 2020).

For 6G, ITU-R is working to publish the global framework for IMT toward 2030 and beyond in 2023 that will provide the basis for defining the future 6G.

The worldwide success of mobile communications from the first generation onward can be seen to be largely founded on the initially proprietary technologies that have subsequently been transferred into a series of standards. Each new technology generation has required a decade of billions of euros investment in research and development to formalize technological innovations into standards and further into hardware and software products and services. Technology standardization has helped to generate foundational innovation platforms upon which emerging technology vendors have developed their products and services. From 1G onward, a similar standard release process has been followed providing standard blueprints for stakeholders to contribute and develop products and network solutions. The stakeholder community for the development has been well defined and stable consisting of a limited number of technology vendors, mobile network operators, system integrators, as well as academia and regulators.

With 5G, the technology ecosystem has been expanded particularly toward enterprises and industries introducing an unprecedented number of use cases and related novel stakeholder groups. Moreover, it should be acknowledged that 5G standardization deviates from previous generations having a coordinated single worldwide major approach to the IMT-2020 requirements. 3G (IMT-2000) was defined by three alternative paths (3GPP UMTS, 3GPP2 CDMA2000 and IEEE mobile WIMAX) and 4G (IMT-Advanced) with 3GPP LTE and IEEE mobile WIMAX alternatives that initially did not have an obvious single winner. Furthermore, 5G service-based architecture with open interfaces, the convergence of communication, information technology and data (ICDT), and user developer centricity will challenge the establish 3GPP grounded IMT process. Recent geopolitical and societal changes—especially related to discussions on data colonialization, user rights, and the use of artificial intelligence, and the digitalization of society and critical infrastructures—have given rise to discussions on the role of nations in standardization. The ongoing technology battle has specifically concerned the leadership in 5G regarding semiconductors, and concerns over sovereignty regarding AI and digital technologies have become an issue (Moerel & Timmers, 2021). As a recent example, the US “Clean network initiative” in 2020 addressed the long-term threat to data privacy, security, human rights, and principled collaboration to free the world from authoritarian malign actors (US Government, 2020). These developments raise the question of the possible fragmentation of the 6G standardization.

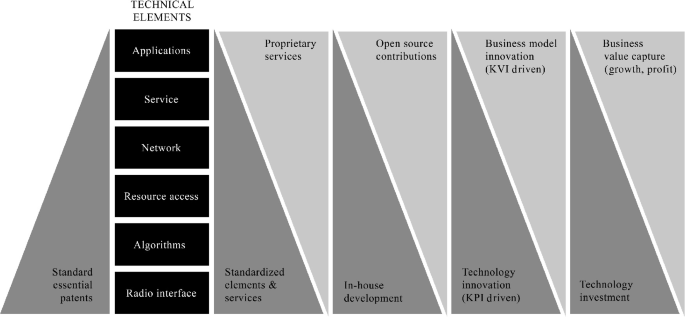

For a half-century, all major mobile communications technology providers have relied on patent licensing as their main value capture mechanism. The European telecommunications standards institute (ETSI) has orchestrated the development and governance of standards, controlling the technology contributors to make licenses available on a fair, reasonable, and non-discriminatory (FRAND) basis for a wide variety of implementers globally. The unique combination of technology co-development and widespread global adoption have been enabled by a nonexclusive licensing model. In addition to standard essential patent (SEP) royalties which have created a continuous incentive for standard contributions, technology vendors have leveraged complementarities via adjacent intellectual property (Teece, 2019).

The collaborative approach has empowered a downstream innovation and a mobile technology and application ecosystem. The standards-compliant ecosystem comprises dedicated technology/chipset firms, infrastructure equipment providers, mobile network operators, device manufacturers, operating system software providers, application developers, and content providers. Many specialized technology firms and vertically integrated companies in the mobile communications industry increasingly engage with two or more roles. Contrary to the single company-owned web-scale “winner-takes-all” digital platforms, harmonized common standards in mobile communications have helped define platforms with many stacked software layers.

A detailed look at the ETSI IPR online database (ETSI IPR) reveals that most 5G patents were declared between 2017 and 2019, and 25% of them were evolutionarily declared already for 4G. The database indicates that radio access networks (RAN), comprising the radio performance, physical layer, radio resource management specification, specification of the access network interfaces, the definition of the operations, and management requirements and conformance testing for user equipment and base stations encompasses about 84% of the SEPs. Physical layers 1 and layer 2 alone add up to 70% of SEPs. Services and systems aspects (SA) covering the overall architecture encompasses approximately only 11% of SEPs despite their leading role in security, management, orchestration, charging, and mission-critical applications areas. The remaining approximately 5% of SEPs are encompassed in the core network and terminals (CT) domain where differentiation and user experience have traditionally been implemented via technology system integration and overall network design, management, and orchestration. All in all, what matters is the device relevance found to be 80–90% of all the SEPs, which is in line with the distribution of licensing royalties (Yrjölä et al., 2022).

With a massive diffusion into new application areas and expanding the circle of stakeholders and licensees in the 6G era, firms may increasingly cooperate vertically in open dynamic multi-layered architectures while competing horizontally to capture value across services. The resulting complex licensing landscape will necessitate more precise rules for FRAND licensing as the exact interpretation and the associated reasonable licensing fees are not precisely defined in the current model (Teece, 2019). The extension toward cross-layered architecture functionalities and including data and algorithms will lead to the convergence of multiple connected ecosystems, introducing new roles and actors, especially related to system integration, management, and orchestration (Yrjölä et al., 2021).

Flexibility, scalability, and efficiency requirements combined with the long-tailed distribution needs of applications, may lead the 6G system to only specify a few core capabilities for the lower system layers with related open interfaces. Thus, higher layer distinct use case specifications for a complete connectivity platform will be done by different actors. For scalability and replicability among connectivity services, the lower-layer processing-intensive radio functions may continue to be specified by global standardization and continued to be implemented in custom silicon chipsets. On the other hand, the modular architecture with open interface specifications will enable the rest of the softwarized, programmable, and virtualized functions to be deployed on any commercial computing hardware. This will facilitate competition and entry, enabling stakeholders to access complementary assets through various forms of alliance with larger firms as well as to specialize within the ecosystem and develop complements to the platform. This suggests that value should be captured increasingly across multiple protocol layers and levels of the industry, and that the role of the de facto standard will need to be revised. Standards for systemic and complex general-purpose technologies, as Fig. 2.2 summarizes, will require coopetitive (i.e., simultaneous collaboration and competition) development to gain interoperability across ecosystems and industries.

One of the key challenges related to profiting from technological innovations in the 6G era is the protection and enforcement of intellectual property while fostering wide diffusion in the ecosystem. For example, starting from the discussion about who should acquire and pay for an SEP license: the OEMs, end-product manufacturers, or connectivity and application module suppliers. It will be essential to find a ruling that avoids the courts’ protracted resolution of licensing disputes, ensures adequate compensation for developers, and promotes widespread use of innovations through appropriate fees. A compromised ETSI FRAND model and a more proprietary vertically integrated model with the reduced IP protection may be priced into products and services (Teece, 2019) and severely reduce the existing significant positive externalities that mobile communications technologies offer and place the envisioned 6G role as a general-purpose technology at risk.

The mobile communications sector is tightly regulated. Regulation takes place at national, regional, and international levels via different methods and focus areas. One fundamental area is spectrum regulation, because the radio spectrum is the most critical natural resource needed for all wireless communications (Anker, 2017). Mobile communication networks need spectrum to operate on and so do all other wireless communication systems such as satellites and terrestrial broadcasting, among others. However, if they use the same spectrum resources, there can be harmful interference that leads to significant service degradations. As a result, different wireless systems have traditionally sought their own exclusive use of the radio spectrum, which has been the foundation for mobile communications.

At the global level, the ITU-R sets requirements for systems to become part of the IMT family, that currently comprises 3G, 4G and 5G systems. At the regional level, coordination takes place between countries in specific regional organizations. In Europe, countries belonging to the European Union follow the European electronic communications code (EECC) directive, which defines the rules for electronic communication networks and services, and the spectrum used for mobile communications is harmonized. Many regulatory topics are a national matter including the actual spectrum awards determining who can deploy mobile communications networks and how. National level regulations consider international and regional approaches and define regulations that are considered appropriate in the country in question.

Spectrum regulation in particular plays a fundamental role in defining how, where, and when the developed technology is used and for what purpose (Matinmikko et al., 2014). Spectrum decisions made at the international, regional, and national levels significantly impact the resulting markets and the mobile communication sector is no exception. For mobile communications, every new technology generation has secured access to new spectrum, which has been internationally harmonized, leading to economies of scale by using the same equipment in larger markets.

Market regulations aim to achieve competitive markets where more than one MNO serves the end user customers in a country. Markets are directly impacted by spectrum regulatory decisions, especially via the rules in awarding of licenses. These national spectrum awarding decisions, which typically use spectrum auctions for mobile communications, significantly influence how many MNOs can operate in a country and how competitive the market is. Additionally, access regulation with rights and obligations concerning interconnection has a major influence on the markets.

Regulatory developments at the ITU-R regarding IMT-2000, IMT-Advanced and IMT-2020 systems have defined the development paths for 3G, 4G and 5G systems. The phases of regulatory development proceed from identifying technology trends and traffic characteristics to defining a joint vision, followed by detailed requirements definition, against which technology proposals are then evaluated. Finally, technology proposals that fulfill the requirements defined by the ITU-R become members of the IMT family and gain access to spectrum bands that are allocated to the mobile service and identified for IMT systems. The spectrum identification process goes in parallel with the IMT system process ranging from identifying spectrum needs based on market studies to studying candidate bands and their feasibility toward spectrum allocation decisions that are made at the World Radiocommunication Conferences (WRCs) of the ITU-R.

Regarding 6G, the process for IMT toward 2030 and beyond, which corresponds to 6G, is underway at the ITU-R. The technology trends have been identified and the report on future technology trends was published in 2022 (ITU-R, 2022). Work on the framework recommendation is ongoing and is expected to be completed in June 2023, presenting new usage scenarios for 6G. After WRC-23, which could develop an agenda item for the 6G spectrum for the following WRC in 2027 (WRC-27), the actual requirements definition phase will start in 2024. The requirements and needed evaluation criteria and processes will be finalized by the end of 2026. Technology proposals on 6G are expected in 2027–2028 with decisions taking place in 2029.

Regarding 6G, standardization phase 1 will likely start from 2025, leading to the first 6G specification in 3GPP Release 21 by 2028 and followed by commercial deployments around 2030. Meanwhile 5G will be enhanced by 5G-Advanced, which will be key focus for 3GPP in Release 18 and19 onward and will power commercial public and private networks starting in 2025. 5G-Advanced will provide new 5G features and boost 5G capabilities in four dimensions: experience, extension, expansion, and operational excellence.

The mobile communications industry has for long been referred to as an ecosystem (Zhang & Liang, 2011). In the current 4G-dominated world that is transitioning toward 5G dominance, the ecosystem comprises hardware providers, software providers, mobile equipment and infrastructure providers, content and application providers, network operators, content providers, OTT (over-the-top) Internet players, service providers such as MNOs (mobile network operators) and MVNOs (mobile virtual network operators), network infrastructure constructors, facility owners, regulatory bodies, and end users (Pujol et al., 2016). However, the way the ecosystem has been seen has changed over the history of mobile communication generations.

Latva-aho and Leppänen (2019) listed 29 different stakeholders for the envisioned 6G ecosystem, categorizing them into human, machine, enterprise, and public-sector type users, each with different demands and needs. In addition, they divided the stakeholders to have two different roles. Resource and asset stakeholders comprise device suppliers, network/cloud infra vendors, complementary technology providers, national regulators, public sector, government, data owners, context providers, content providers, context owners, edge cloud, data center, facility owner, site supplier, and building constructors. Meanwhile, matching and bridging stakeholders included mobile virtual network operators, mobile network operators, fixed operators, satellite operators, vertical-specific service providers, roaming service providers, application providers, digital twin providers, management service providers, data brokers, network resource brokers, broking/bridging providers, trust providers, and providers of security as a service.

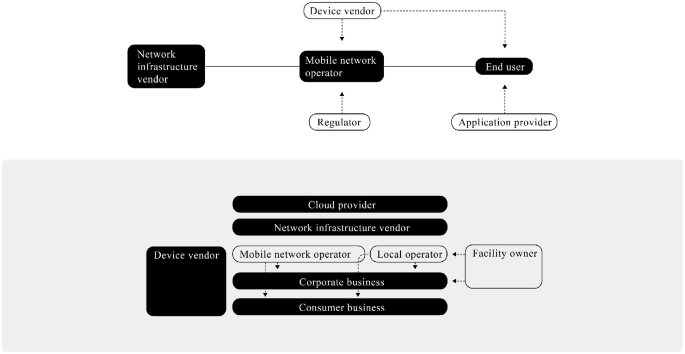

Thus, the value chain in the mobile communication sector has evolved over the technology generations. The 2G era included state-owned MNOs and the market was opened to competition from new private MNOs. The value chain in 2G typically consisted of network infrastructure vendors, MNOs, device vendors, end users, and the regulator as depicted in Fig. 2.3. 3G introduced mobile broadband, which made new services and applications available over the networks. Otherwise, the value chain remained as it was in 2G, but competition increased in several markets with new market entry, leading to market consolidation later. 4G brought mobile broadband on a large scale and MNO networks became bit pipes for OTT services. In the 4G era, the role of OTT services increased and the number of MNOs per country decreased as a result of acquisitions by the MNOs.

The 5G era has introduced local networks deployed by different stakeholders, which has opened the market for new local entry. This development is still ongoing and varies a great deal between countries (Matinmikko et al., 2018). Local 5G networks have created local vertical specific ecosystems around their deployment areas where the stakeholders and their roles vary. Examples of this include the port and factory ecosystems.

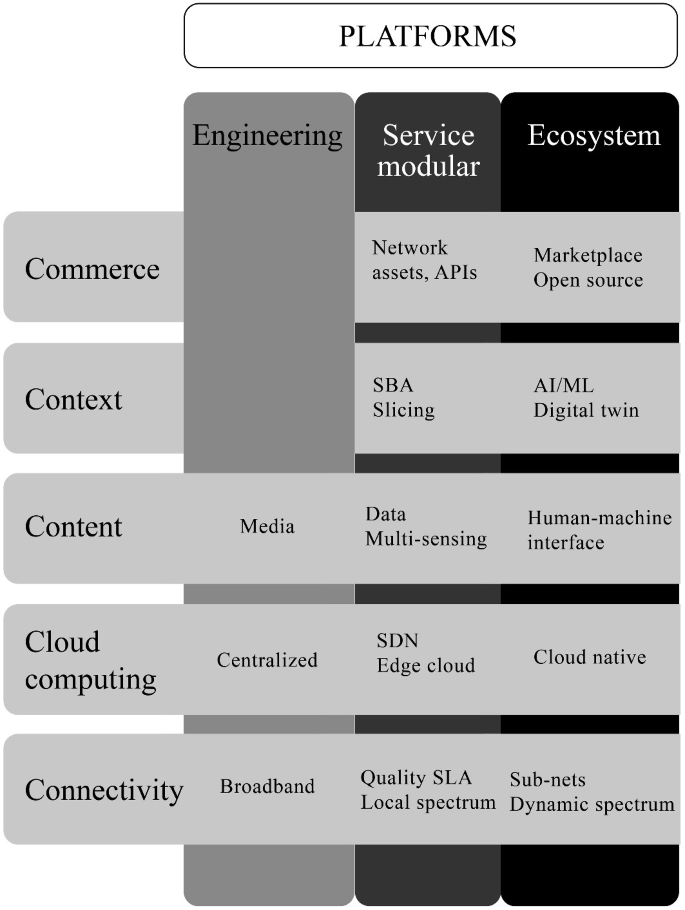

The definition of 5G opened the opportunity to change from connectivity-centric business models toward various connectivity with bundled content (data-based), context (location-based or service-specific), and commerce (platform) business models and offering the whole network as a service (NaaS). In parallel to this development, a disruption in the deployment models of mobile communication networks took place in the 5G era disrupting the ecosystem by enabling new entrants, such as utilities, ports, and manufacturing plants, to run their own local private 5G networks (Matinmikko et al., 2017). Additionally, other technologies such as cloud computing, AI, and Web3 have started to converge with or complement 5G introducing cloud computing “the fifth C” into the 4C business model characterization framework (Wirtz et al., 2010) as depicted in Fig. 2.4.

Figure 2.4 illustrates the evolutionary view of the mobile communications system from the 4G engineering connectivity platform via 5G service modularity toward 6G connectivity platform-based ecosystem. In the 5C framework, the connection layer includes physical and virtualized communication network infrastructures for the ecosystemic value proposition of exchanging information. The newly introduced cloud computing infrastructure is an essential enabler for a variety of data and intelligence-based services. The third content layer aims to collect, select, compile, distribute, and present data in the ecosystem in a value-adding, convenient, and user-friendly way. In the context layer, the aim is to provide a structure, increase transparency, and reduce complexity by providing a platform for stakeholders’ communication and transaction. Finally, the commerce layer focuses on negotiation, initiation, payment, and service and product deliveries in the ecosystem, enabling low transaction costs and providing a cost-effective marketplace for matching and bridging supply and demand.

Despite massive investment in the current mobile communication networks, the MNOs’ opportunities for differentiation have been limited. The differentiation capacity has shifted toward devices and content and the mobile operating systems have become bottleneck assets in the mobile ecosystem. 5G can be seen as a service modular platform system stemming from interfaces that enable complementary offerings of elements and services. The digital platform business model enables software developers to add value through applications and complementary assets to the ecosystem by attracting users and building network effects. The ecosystemic 6G connectivity platform-based model facilitates value co-creation, co-capturing, and sharing to maximize the overall value generated and acquired not only by a focal traditional incumbent MNO but also by the ecosystem’s stakeholders. The 6G ecosystem can be seen both as an innovation engineering platform and e-commerce transaction platform (Evans & Gawer, 2016). This will enable digital business ecosystems to facilitate exchanges of otherwise fragmented groups of consumers and/or firms and to provide a technology and distribution system for other companies to base their technological and service innovations. Introduced service modularity on 5G platforms will on one hand enable fast-paced autonomous innovation, but on the other hand it will change the appropriability mechanism by reducing the role of complementary core assets.

In 6G, the systemic architecture level innovations will be vital in enabling business model changes. Key transformational bottleneck assets such as AI/ML and human–machine interfaces (HMI) as general-purpose technologies will be leveraged across distributed a heterogeneous 6G cloud architecture. Intelligent 6G networks are based on common enablers for AI as a service, and federated learning as-a-service that leverage data acquisition, data exposure and a common cross-domain analytics framework. Intelligent network enablers will operate across the cloud continuum from the central cloud to the edge and to far edge including the UE. Extreme scalability and flexibility will become the new paradigm in 6G. Network automation and orchestration will be integral parts of intelligent networks using AI and analytics to manage and orchestrate the networks in a fully automated manner across all layers and parts of the network abstraction (Kaloxylos et al., 2021).

The primary focus in the current 4G and early 5G deployments has been on network planning, network diagnostics, and network optimization and control reducing capital expenditure, optimizing network performance, and building new revenue streams through the improved customer experience. 6G radios are envisioned to adopt AI/ML in a fundamental way for optimized air interface design, cognitive dynamic spectrum use, and context awareness. On the network level, hyper-specialized agile slicing will call for new fully AI automatized service management and orchestration for network automation, allowing dynamic adaptation of network resources according to changing service requests, reducing the deployment time of new services and mitigation of failures, and significantly reducing operating expenditure. Digital trust, enabled by quantum computing and distributed Web3 ledger technologies such as blockchain and smart contracts, will provide businesses securely and predictably with world-class cybersecurity, public safety, and fintech solutions.

Human augmentation will enable people to interact with and within the digital world. This will include VR headsets, XR glasses, remote control with haptics, and, in the future brain-machine interfaces and connected bio-medical implants. The fusion between the digital and physical realms will further enhance our capabilities to interact with dynamic representations of real-world objects, systems, and processes in the digital world such as digital twins and 6G network sensing data. Downstream digital application platforms will converge and there will be multimodal engagement with media, and the physicality of lived experiences will be seamlessly accessible through a HMI extended to all five senses, including the senses of touch and taste. Individual and collaborative users will seamlessly be able to switch between any form of immersive mobile extended reality, encompassing virtual reality, augmented reality, and mixed reality, comprising both virtual and augmented objects. HMI opportunities will be clearly differentiated between the consumer, the enterprise, and the industrial segment.

Disruptions on multiple levels are a visible part of both organizational life as well as economic reality these days (e.g., Buckley, 2019). In the last few years, global industries have faced disruptions in the form of the China-US trade war, the technological war between different centers of power especially in emergent industries (Chin, 2019; Lukin, 2019; Petricevic & Teece, 2019), COVID-19, and more recently the Russia-Ukraine war. As a result, in recent times, we have witnessed a plethora of terms emerging; out of which the most famous is VUCA (volatility, uncertainty, complexity, and ambiguity) as a permanent feature of the current economy (Bennett & Lemoine, 2014; Millar et al., 2018) especially in industries which are significantly intertwined with global value creation. In this context, mobile communications is one of the sectors that has been very visibly linked to most elements of global disruptions because of its criticality to the economic competitiveness as well as its visible interlinkage to the emergent digital business models (Kilkki et al., 2018). A well-known example in this regard is the Chinese telecom giant Huawei which has received bans and strict oversight in different Western countries including USA due to the concerns about privacy and security. As the shift toward 6G is taking shape globally, there is a race for setting the standards, and geopoliticalGeopolitical disruptions (and considerations) are a core aspect of this debate (Klement, 2021; Yrjölä et al., 2020). At the same time, it is vital to stress that the influence of a variety of global disruptions on 6G development and planned implementation has not been studied specifically so far; thereby showing a visible gap in the extant literature.

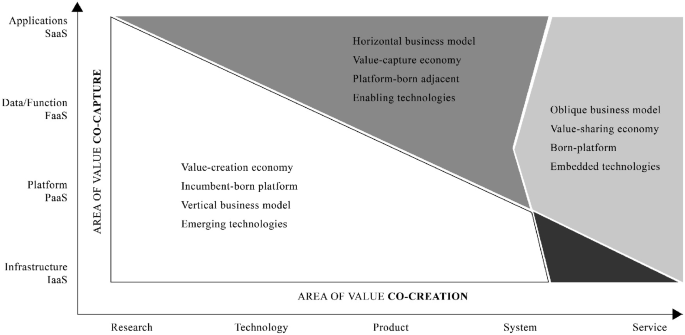

In the engineering tradition, platforms have been seen as modular technological designs for facilitating innovation, whereas in the economics tradition platforms have been seen as two- or multi-sided markets connecting supply and demand. The traditional approach to a mobile communications ecosystem is based on a layered protocol-based technical infrastructure, an engineering platform consisting of elements and interfaces. As in digitalized industries in general, in mobile communications, business models can be seen to follow the nature of integration—vertical or horizontal (Ballon, 2007). The previous 4G and 5G business architectures have considered the ecosystem configuration either through vertical or horizontal business models as depicted in Fig. 2.5.

In the vertical business model, traditionally employed in mobile communications, a firm controls its suppliers, distributors, or retail locations as part of its supply chain. To be competitive in this supply-sided model, a firm focuses on creating value for its customers, and is grounded inside its selected verticals. On the 4G engineering platform, a competitive advantage arises from focusing on value creation within narrow segments around connectivity and content (Ahokangas et al., 2019). As interfaces in mobile communications have been largely defined from the inside-out perspective, the telco APIs have not reached the developers’ ecosystem, and infrastructure providers have been controlling the complete technology and service solution (Basole & Karla, 2011). In the industry transition from 4G to 5G, the vertical integration strategy has been clearly visible with the acquisition of business operations within the same vertical. Deployed incumbent-born mobile communications connectivity platforms have typically been upstream platforms and dependent on the core product (Pundziene et al., 2022) and slow to respond to market dynamics.

The introduction of 5G has transformed the traditional vertical business model approaches of the mobile sector toward a horizontal model (Cave, 2018). The horizontal business model, adopted in consumer service-oriented businesses, to serve a wide clientele across different segments focuses on economies of scale and scope in order to maximize the value capture. This demand-side approach enables multiple stakeholders to focus on their respective fields through a common framework that allows faster innovations and a rapid scale-up of applications and businesses. Technological innovations, extreme cost consciousness, and risk awareness have been characteristic in capturing customer value while defending a position against competition. The horizontal 5G business models are highly dependent on the supporting infrastructure and complementors to run smoothly. The introduced service-based architecture (SBA) with softwarization and cloudification technology has enabled demand-side platformization (Camps-Aragó et al., 2019) that enables innovative as-a-service business models to serve a wider value constellation (Hmoud et al., 2020). The novel serverless cloud-native model allows developers to build and run applications without having to manage servers. IT and cloud Webscalers’ platform-born adjacent platforms can serve downstream users via transformative service innovations (Pundziene et al., 2022).

In the 6G era, the vertical integration in the value chain and/or horizontal diversification to any segment is unlikely as digital service chains are becoming more distributed, abstracted, and advanced built on resources provided as-a-service. Concepts centered around network-as-a-service (NaaS) will be very mature by 2030, and everything that can be offered as a service will be (Yrjölä et al., 2022). Cloud native design, open source, and standards will drive openness in the architecture of networks and operations, while enabling technologies such as hyper-specialized virtualization and slicing, abstracted data, while analytics capabilities will provide the right building blocks (Yrjölä et al., 2021). Simple-to-consume low-code/no-code APIs and network-as-a-code, backed by new levels of AI/ML-driven automation will be the enablers of new business and revenue for all players. This will require increased coopetition among network function vendors, network service providers, application service providers, and hyperscale companies, within an evolved ecosystem. In modern IT and software development, DevOps and infrastructure-as-a-code (IaC) are already mainstream, and SW developers are the drivers of a new kind of innovation and service delivery (Morris, 2016). This multi-sided platform-of-platforms model integrates the supply and demand side and can be seen to form a sharing economy. Wide adoption and maturity of business-to-business marketplaces are emerging for enterprises and IT in hyperscale cloud ecosystems. These developments will define the traction for telco exposure and abstraction with mobile in moving toward hybrid oblique business models. The oblique business model views 6G as a general-purpose technology and envisages network-as-a-code for developers. A loosely coupled oblique business model (Amit & Zott, 2015; Saebi & Foss, 2015) can be seen to follow the rationales of open innovation (Chesbrough, et al., 2014) and the timely concept of a sharing economy in which resource efficiency plays a crucial role (Stephany, 2015). In the 6G era, business models will not be built on one-sided technology or in industry silos, because it will be essential to consider the lifecycle stage of complementors, customers, and partners in the ecosystem. In a value-sharing economy, a cumulative, open-sourced effort of a community of developers will turn customers’, and ecosystems’ underutilized assets into more efficient or better used assets with fast-to-market strategies (Bogers & West, 2012; Chesbrough et al., 2014). Stakeholder interactions will aim to achieve common strategic objectives and eventually share a common fate and will no longer be based on customer–supplier relationships, (Iansiti & Levien, 2004). The oblique 6G business model characteristics will enable a novel born-platform approach, which will be a stand-alone multi-sided platform type of architecture building on a digital platform value proposition from the beginning of a new venture aiming at new market creation (Nambisan, 2017; Pundziene et al., 2022).

Despite the wide streams of platform and ecosystem business literature, little effort has been made to advance a coherent theory on hybrid ecosystemic platform-based business models that combines the characteristics of the both the transaction platforms focusing serving or mediating exchange and interactions (McIntyre & Srinivasan, 2017, p. 143), and the innovation platform creating value through enabling innovations on the platform (Cusumano et al., 2020). 6G platforms can be seen as a composition of interacting subsystems that will always to some degree be interdependent and interoperate exclusively using predefined, stable interfaces (Eisenmann et al., 2006).

We emphasize the role of multi-sided platforms (Teece et al., 2022) to organize collaboration and control without owning the services whose exchange it inter-organizationally facilitates and governs. Moreover, the value co-creation (Saebi & Foss, 2015) by a compilation of peripheral enterprises connected to the platform via shared or open-source technologies or technology standardization (Cennamo & Santaló, 2013; Jacobides et al., 2018) will be seen in 6G. Similarly, the logic of value co-captured via sharing and distributing the revenue among ecosystem members, not only to capture by the focal enterprise can be envisioned (Oh et al., 2015; Upward & Jones, 2016; Zott et al., 2011).

The 6G ecosystem will be associated with both product and service systems (Tsujimoto et al., 2018), and both upstream and downstream value network actors, as well as related technologies and institutions with a varying degree of not fully hierarchically controlled multilateral, non-generic complementarities (Adner, 2017; Iansiti & Levien, 2004; Jacobides et al., 2018). This ecosystemic model will build upon customer-centricity (Weil & Woerner, 2015) and the dynamics of industry transformation, moving toward sustainable business, and can be viewed as an engine of social progress (Lüdeke-Freund et al., 2018), while the value-in-exchange may be captured on multiple levels (Lepak et al., 2007). The discussion above leads to the proposition of seeing ecosystem and platform concepts to be intertwined and thus defines a 6G ecosystemic platform-based business model as follows: An ecosystemic platform-based business model will connect various sides of multi-sided markets to facilitate value co-creation, co-capture, and sharing on multiple levels over a platform that facilitates interaction between users to collectively create innovations via matching, complementing, or sharing their resources sustainably.